About Rockstone Financial Training

At Rockstone Financial Training (RFT), our mission is to empower aspiring financial coaches with the knowledge and tools necessary to confidently navigate the details of personal finance. By providing comprehensive education and training, we aim to create a community of skilled financial coaches who inspire positive change and guide others toward lasting financial well-being.

We offer a range of educational options from short online classes to larger more in-depth online self-study training programs. Our signature program, “The Rockstone Financial Coach Training Program”, is a comprehensive training program that provides aspiring financial coaches with the financial education and business skills needed to run a thriving coaching practice. The program is carefully structured into three parts, view our three-part structure.

Our Three-part Structure

We provide in-depth training on core financial topics such as budgeting, debt management, credit and savings. Other topic areas are included to ensure that you understand the key concepts of personal finance so you can confidently educate and guide your clients. Those topic areas consist of major purchases, different types of home loans, insurance and many more.

We teach you the coaching process from start to finish so that you can help your clients reach their financial goals and build a positive relationship with money.

We help you start your own financial coaching practice by equipping you with the essential elements of business startup, giving you the tools you need to run a thriving coaching business.

Our Approach

Our holistic approach ensures that you’re not only well-versed in financial topics, but also equipped to guide your clients through their financial journey while building a sustainable, impactful coaching business.

If you're looking to become a financial coach and launch your own coaching practice, RFT is here to help.

Our Courses

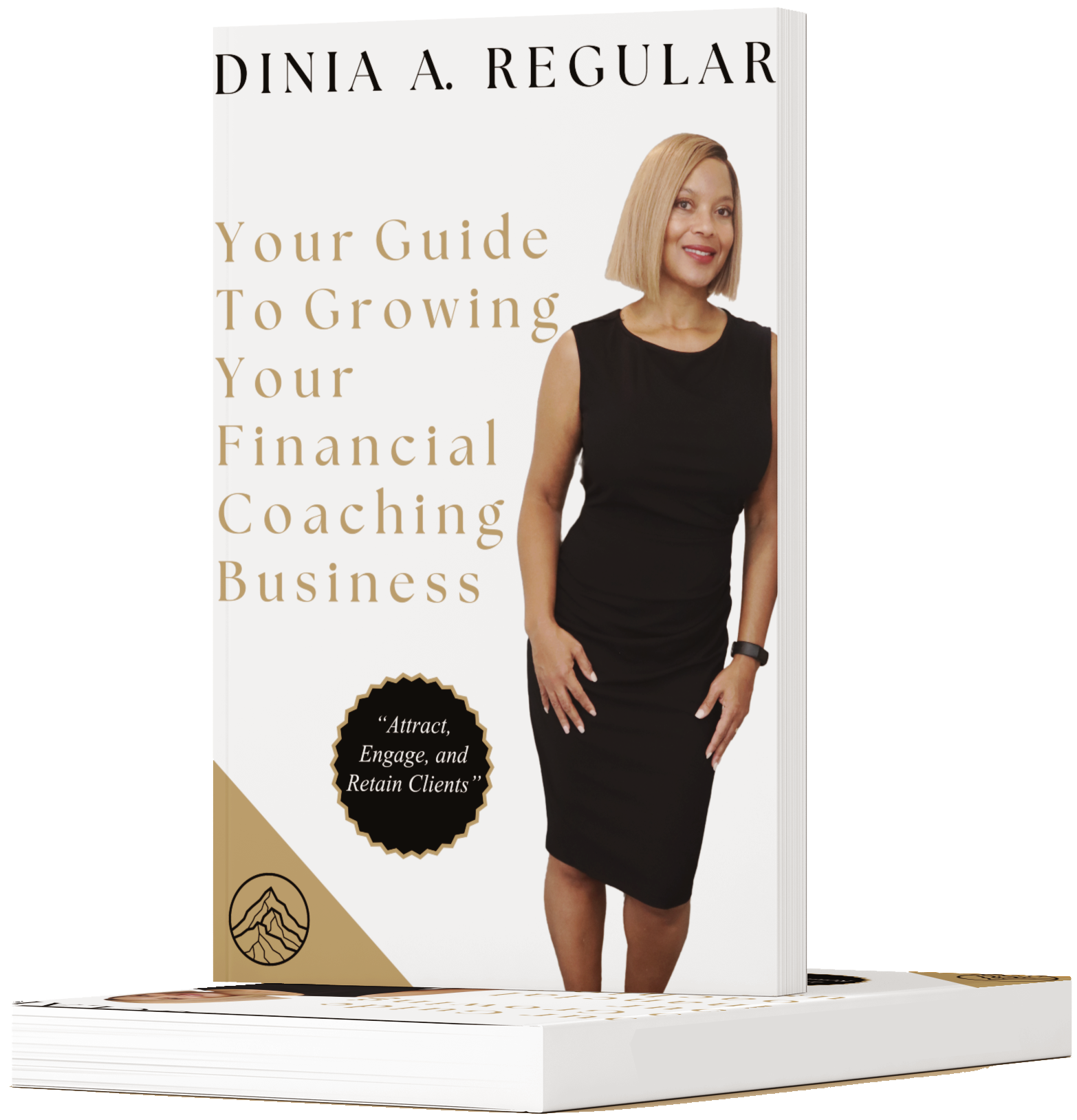

Our Books

My Perspective of Personal Finance

Navigating the world of personal finance requires not only financial knowledge, but also a perspective that reflects your values and principles in which you live by.

Here's a closer look at the five principles that highlight my perspective on personal finance:

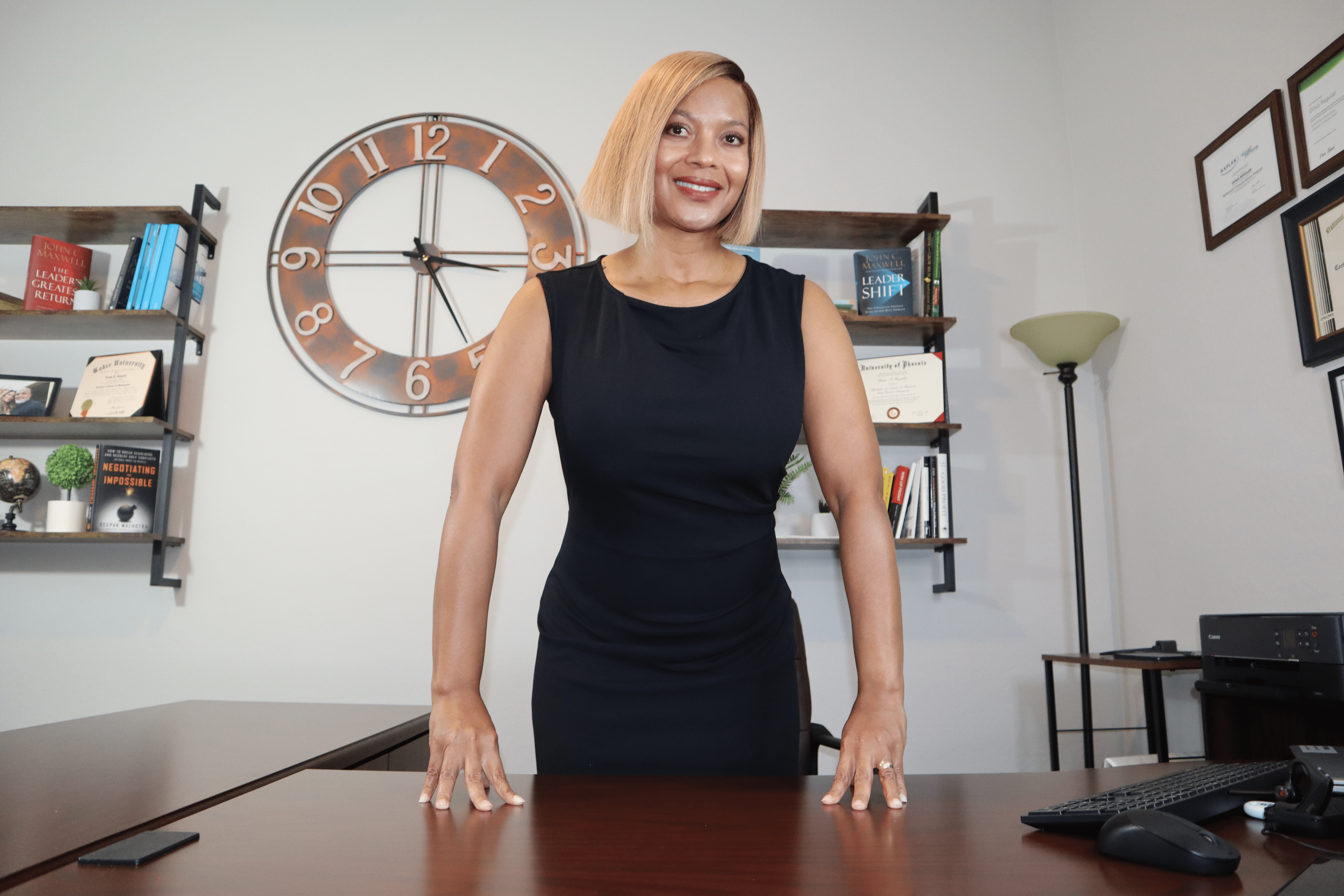

About The Owner

Dinia A. Regular is a seasoned finance professional with over 25 years of experience spanning retail banking, investment management, and financial education. Her career began in retail banking, where she honed her skills as a lobby teller, commercial vault teller, and ATM servicer—developing a hands-on understanding of money management. Dinia transitioned to an office management role at an investment firm, where she excelled in coaching office managers and financial advisors, delivering award-winning client service, and leading training initiatives.

A lifelong learner, Dinia holds an associate degree in business and a bachelor’s degree in global business management with a focus on international business. She has earned multiple professional certifications, including Behavioral Financial Advisor (BFA), Certified Personal Financial Wellness Consultant (CPFWC), Certified Financial Education Instructor (CFEI), Certified Professional Coach (CPC), and Certified Marketing Coach (CMAC). These credentials reflect her dedication to empowering individuals through financial literacy and entrepreneurship.

Dinia combines her extensive experience and educational background to inspire and guide aspiring financial coaches. Her approach emphasizes relationship-focused coaching, fostering trust, and crafting personalized strategies to help clients achieve lasting financial success. Through her work, Dinia is passionate about equipping others with the tools and knowledge to build impactful, sustainable coaching practices rooted in integrity and excellence.